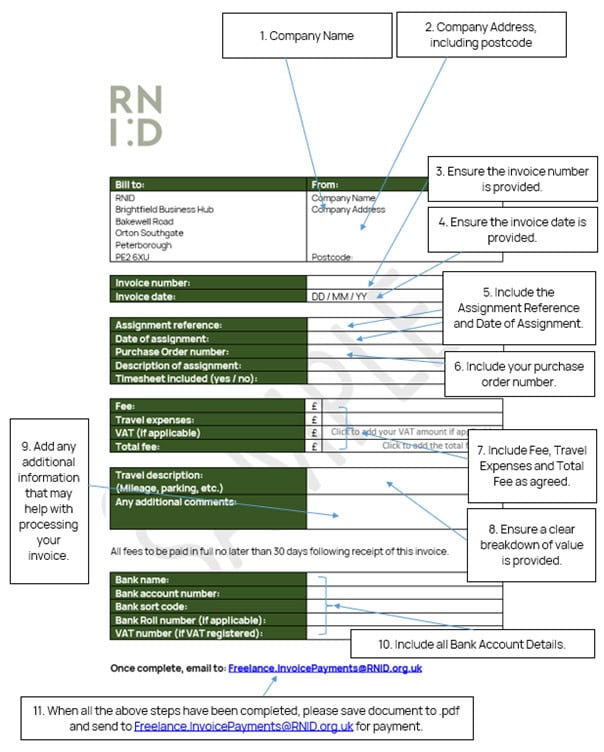

To make sure we can process invoices quickly and efficiently, we ask suppliers to follow these good invoice guidelines.

1. Your company name

Make sure your company name is clearly stated on the invoice.

This will allow your invoice to be paid correctly.

2. Company address

Make sure your company address (including postcode) is shown on the invoice.

3. Missing details

Missing details may result in delayed payment or returned invoices. Please make sure all relevant telephone and email addresses are also provided as this will allow us to contact you quickly if there is any reason why your invoice cannot be processed.

4. Identifiable invoice number

Ensure that your invoice has an identifiable invoice number stated. This needs to be a unique reference number, with no additional characters (i.e. #, !, * etc.). Invoices received without an invoice number will be returned.

5. Tax point/invoice date

Ensure the tax point/ invoice date is clearly shown, including the year. This allows us to action your invoice within the correct payment terms. The invoice will not be paid if the “year” is not included.

6. Assignment reference and date of assignment

By providing the assignment reference and date of assignment, this will allow the invoice to be processed more swiftly.

7. Purchase orders

Quote all purchase order (PO) numbers provided. Not providing the correct PO number will delay the payment of your invoice. Please ensure you state the PO number as given to you by RNID without adding/deleting any letters/digits. Please note that quoting an incorrect or expired PO will cause delays in payment. If you do not have the PO number, please get in touch with your RNID contact to obtain one and update your invoice. RNID will only accept one PO per invoice.

8. Include all goods and services

Make sure all goods/service details are provided. Advise of quantity billed, item description, unit price and total value. If all the information is provided it will enable the invoice to be processed easily allowing for prompt payment. Missing information could delay payment.

9. Breakdown of invoice value

Make sure a clear breakdown of invoice value is provided. Invoices that are calculated incorrectly will be returned. Make sure a clear VAT breakdown is provided to avoid delays.

10. Comments

Include any important comments on your invoice, this may help speed up the processing time.

11. Bank details

Quote all relevant bank details. Please quote all remittance addresses to allow us to email the remittance to the correct email address.

12. Email the invoice to us

When the invoice has been completed, please e-mail to [email protected]

In addition, please ensure your invoice:

- is in .pdf format (no other document formats are accepted)

- each invoice should quote only one PO number

- you’ve attached any relevant supporting information, such as timesheets.

Download our invoice formats

You can download our sample invoice in Microsoft Word or PDF format.

Download our invoice sample (Microsoft Word, 80kb)

Download our invoice sample (PDF, 83kb)

Contact us

If you are deaf, have hearing loss or tinnitus and need free confidential and impartial information and support, contact RNID.

We’re open 8:30am to 5pm, Monday to Friday.